In short: How to manage EACs more efficiently

Efficient energy attribute certificate management in 2026 comes down to three actions:

- Document your end-to-end EAC lifecycle, from origination through invoicing. A shared understanding of the teams, tools, and processes in EAC portfolio management is a necessary foundation for meaningful improvement.

- Centralize EAC data to improve forecasting, hedging, allocation, and also to prevent negative outcomes like missed deliveries and double booking.

- Operationalize EAC processes, leveraging automation to meet market needs while preserving profit margins in a price-sensitive market.

With the right processes and technology built for EACs, utilities can turn an increasingly complex certificate market into a strategic commercial advantage.

Managing an energy attribute certificate (EAC) portfolio is difficult. Variation in deal structures, complex delivery timelines, narrow contractual specifications, and the technical barriers to consolidating data across internal systems and registries all contribute to a challenging operational environment.

This article outlines three ways EAC portfolio managers can operate more efficiently in 2026, drawing from practices adopted by industry-leading utilities and traders. These approaches help reduce operational risk, improve visibility, and free teams to focus on higher-value activities.

Why managing energy attribute certificates is becoming more complex

EAC Traders and Portfolio Managers know better than anyone how quickly the EAC landscape is evolving. Three factors in particular are increasing the complexity of the market:

1. Market expansion brings price volatility and margin pressures

The volume of certificates in circulation continues to grow rapidly. As of July 2025, more than 227 million I-REC(E) were issued globally, a 12% increase compared to the same period in 2024. The European market is scaling even faster: valued at $7.2 billion in 2024, it is projected to reach $19.7 billion by 2034, growing at a 10.6% CAGR.

Rising volumes can mean more contracts to manage, more price curves and positions to monitor, more deliveries to complete, and more opportunities for errors.

Yet at the same time, the Guarantees of Origin (GO) market has seen steep price declines. Prices fell from €7–8 in 2023 per megawatt-hour of energy produced to €0.20–0.40 in 2024. At this level, even small operational mistakes—like late cancellations or mismatched deliveries—can wipe out profits entirely.

You can no longer afford inefficient processes.

2. Increased contract complexity

While EACs are tradeable instruments rather than physical electricity, they each correspond to 1 megawatt-hour of electricity produced. As the certificate market matures, we see regulatory and demand forces leading to tighter, more granular matching of EACs between production and consumption.

On the regulatory side, EU-wide initiatives such as RED II, CSRD, and numerous local regulations are mandating increasing disclosure and more granular disclosure periods.

On the demand side, industrial consumers are becoming more sophisticated buyers. This translates into contracts with narrow specifications (e.g., a specific technology mix, plant vintage, or even certificates from specific plants).

3. Reliance on outdated tools

Despite the high stakes and complexity, many utilities still manage EACs in spreadsheets. A recent study found that Excel remains the dominant tool, even though some errors have caused losses of over €500,000.

Another study by CerQlar had similar findings, with one interviewee saying: “Participants revealed that they still rely on outdated technology such as spreadsheets, email, and even phone calls to manage trades and inventory. This results in information being siloed… exchanged via email or other manual communication.”

Against this backdrop, utilities need smarter, automated, data-driven approaches to managing their EACs.

3 ways to make your EAC portfolio management more efficient

Here are three strategic actions utilities can take to reduce risk, simplify workflows, and increase the profitability of their EAC portfolio.

1. Document your end-to-end EAC lifecycle

Though it may seem obvious to the point of absurdity, it is in fact paramount to thoroughly map the end-to-end EAC process before starting to implement process changes. This helps:

- Clarify portfolio objectives. Is your EAC portfolio part of a trading desk designed to drive profit, or does it exist primarily as a guarantee to contractual obligations?

- Establish a baseline for improvement

- Identify efficiency opportunities that may not be visible day-to-day

- Uncover risks and operational blockers

- Support decisions around whether issues can be solved with quick fixes or require structured projects

- Engage stakeholders, creating better conditions for successful change management

Depending on the organization, this mapping process can range from a half-day exercise (for a one-person Green Desk) to a multi-week effort involving Origination, Trading, Mid-Office, Back Office, IT, Compliance, and Finance.

Mapping the EAC lifecycle typically involves understanding three core components:

- Core Processes

- What are the stages in an EAC contract lifecycle, from Origination/Issuance through Invoicing?

- What are the handovers between teams?

- What exceptions or edge cases happen regularly?

- People

- Who is involved in each stage (internally and externally)?

- What are their responsibilities and KPIs?

- How do teams currently collaborate, or fail to collaborate?

- Tools

- What tools are used for communication, forecasting/hedging, reconciliation, assignment, invoicing, etc.)?

- How do these tools integrate with each other?

- Which tools are governed by external constraints (e.g., registry interfaces or software licenses)?

The ideal deliverable is a flow chart or similar visual that maps multiple scenarios (e.g. Buy Trade, Sell Trade, PPA, assignment flows) from beginning to end. This becomes the basis for deeper questions such as:

- How aligned is the current setup with the organization’s strategic objectives for EACs?

- Is the setup future-proof against regulatory, market, or technology changes?

- Is the business unified and consistent in how it handles EACs across regions, teams, or portfolios?

- Where do visibility gaps exist between Front-, Mid-, and Back-Office functions?

Most teams discover a combination of misalignments, manual workarounds, inconsistent data sources, and role ambiguity.

2. Centralize EAC Data

The next step is to centralize your EAC data in one place, so that you have a single source of truth rather than data scattered across many systems.

Data relevant to EAC portfolio management typically includes contracts & deals, forecasts, counterparty details, plant specifications, and registry data (current account balance and historical movements).

This information is often fragmented across spreadsheets, registry portals, email inboxes, shared folders, internal trading tools, ERP systems, and customer CRMs all contain fragments of EAC-relevant information. In practice, this creates:

- Inconsistent inventories

- Delayed decision-making

- Difficulty forecasting net positions

- Operational blind spots

- Missed cancellations or deliveries

- Challenges reconciling customer allocations with underlying assets

- Higher audit and compliance risk

When certificate volumes were lower and contracts were simpler, these inefficiencies were manageable. But with the rise in issuance volumes and contract specificity, fragmented data is now a structural barrier to effective portfolio management.

A data consolidation project can look quite differently depending on portfolio objectives, existing technology stack, and IT resources. Within the context of EAC portfolios, the consistent theme is finding a reliable, secure, and scalable way to consolidate contract and certificate data.

Centralizing data unlocks better decisions

With a centralized EAC inventory:

- Originators understand available supply for customer contracts

- Portfolio Managers see their entire portfolio in one place

- Traders know their real-time positions

- Compliance teams reduce reporting time

- Risk managers model exposure across products

This holistic view enables better forward planning, more accurate hedging, and stronger commercial control.

3. Operationalize EAC processes

With an aligned lifecycle and centralized data foundation, focus can expand to the processes that move certificates and their contracts from issuance through cancellation and invoicing. In today’s market, even marginal process improvements can meaningfully impact profitability.

Automation plays a crucial role here; when certificate prices are low, the cost of human error can exceed the value of entire trades.

Key areas where automation creates measurable impact:

- Capturing/updating contracts and production forecasts

- Matching inbound and outbound volumes (i.e. Forward Allocation)

- Calculating accurate net positions (long, short, hedged, unhedged)

- Auditable reconciliation of inbound volumes across registries and portfolios

- Managing upcoming deliveries and expiries

- Consistent allocation logic for deliveries across teams and regions

- Simplified risk reporting for internal and external stakeholders

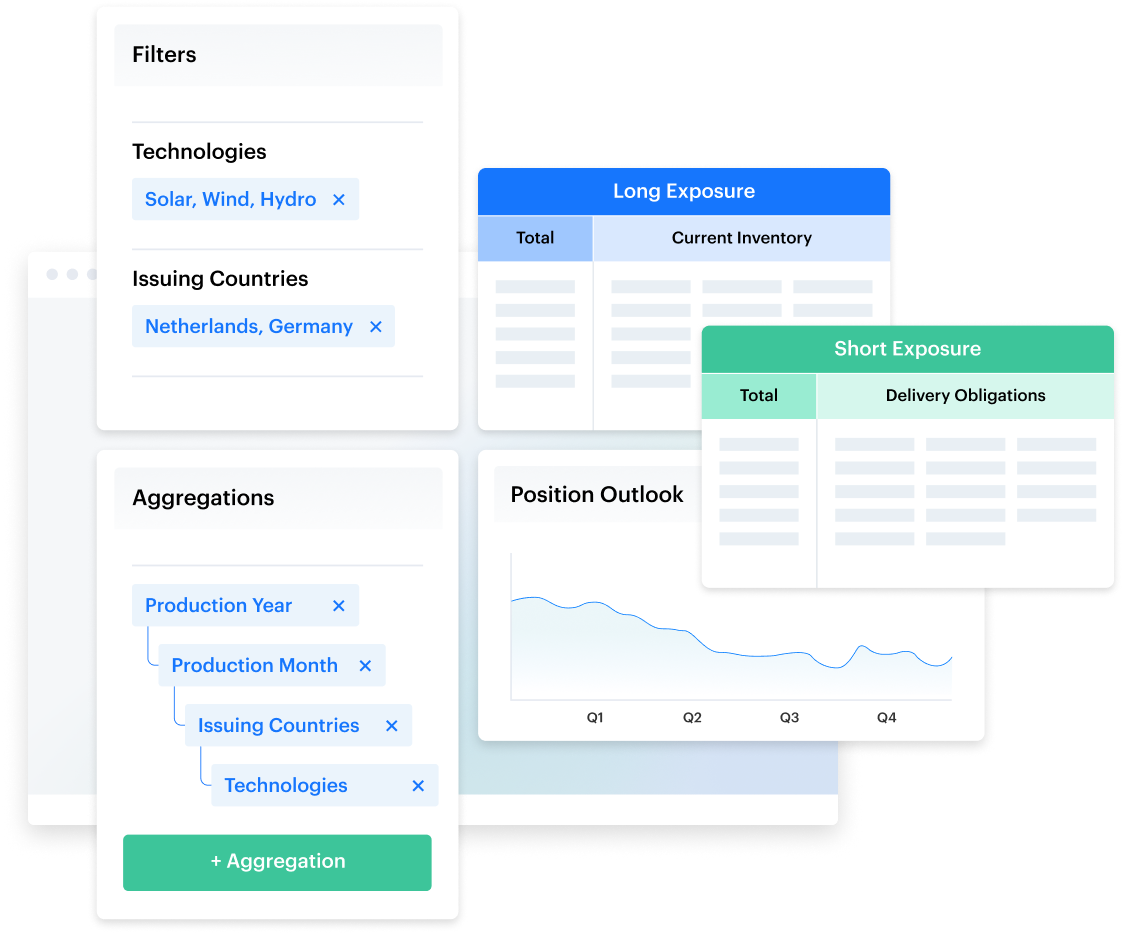

For utilities with EAC trading desks, a centralized data foundation enables alignment across the entire organization. The Front Office gains clarity on trading and hedging opportunities, Mid-Office gets better oversight of risks and exposures, and Back Office can complete settlement and reporting tasks with greater accuracy.

How to simplify your renewable energy certificate management with CerQlar

Outdated approaches like using spreadsheets are no longer suitable for managing EACs. Switching to a certificate management platform like CerQlar gives you a real-time, holistic view of your portfolio, so you can accurately manage your EACs and stay compliant with existing and future regulations.

Automated workflows save you time, and advanced analytics and custom dashboards help you make smarter decisions for your portfolio and generate audit-ready reports on your activities.

Want to learn more about how CerQlar can help make your EAC processes more efficient? Book a demo with one of our experts.

The final Scope 2 Standard will likely fall somewhere in the middle, but either way, companies who buy and sell GoOs need to start improving how they manage them sooner rather than later.