Empowering Change: ESRS Legislation and its Impact on the Renewable Energy Market

The European Sustainability Reporting Standards (ESRS) represent a seismic shift in corporate obligations, mandating market-based energy consumption reporting for an expansive cohort of nearly 50,000 companies. Embedded within the Corporate Sustainability Reporting Directive (CSRD), these standards introduce fresh disclosure requirements spanning environmental, governance, and social facets across the EU corporate arena.

Specifically targeting energy reporting, the ESRS directive demands comprehensive disclosure of both location-based and market-based emissions from acquired electricity, heating, and cooling – encapsulated as Scope 2 emissions. Notably, the ESRS firmly establishes the market-based method as the exclusive approach for reporting energy consumption, necessitating entities under the CSRD umbrella to substantiate their renewable energy utilization through contractual instruments such as Guarantees of Origin (GoOs).

Let’s explore the impact of the new ESRS legislation on the renewable energy market.

Discover how EACs can empower your company’s sustainability journey with our free ebook Unlocking corporate sustainability: The power of EACs for corporate disclosure.

Understanding the new reporting standards

The ESRS legislation marks a significant shift towards enhancing transparency and legitimacy in green investments within the realm of the European Green Deal’s climate ambitions. Going beyond mere compliance, the ESRS is poised to deliver critical sustainability performance data to financial entities, serving as a cornerstone for investment allocations. Institutions like the European Investment Bank (EIB) have already embraced these standards, utilizing them as evaluative benchmarks for projects aligning with the EU Taxonomy. This convergence of sustainability reporting and investment scrutiny signifies a substantial leap towards a more transparent and sustainable corporate landscape across Europe.

Mandating a “double materiality” perspective, the ESRS demands holistic reports that delve into societal, environmental, and financial impacts, aligning business practices with sustainability goals. This shift, departing from conventional frameworks, encapsulates the “Inside Out View,” evaluating social and environmental impacts on finances, and the “Outside In View,” considering external events’ effects on companies. These changes are part of the broader EU initiative, the Fit for 55 package, driving the European Green Deal’s climate ambitions into enforceable laws.

Unlocking ESRS advantages in renewable energy

The ESRS legislation emerges as a catalyst for positive change in the renewable energy sphere, wielding its comprehensive reporting requirements and emphasis on renewable energy disclosures to instigate a series of beneficial impacts within the market. Its mandate for detailed reporting, specifically within the E1-5 categories, brings forth heightened transparency, requiring explicit identification of renewable energy sources in contractual arrangements. This provision is anticipated to drive a surge in demand for GoOs, particularly from larger organizations mandated to report by 2024.

This upsurge in GoO demand is poised to spur innovation and investment in renewable energy. As companies strive to fulfill disclosure obligations, the market could witness an amplified focus on the production and acquisition of renewable energy certificates like GoOs. Such a surge in demand may catalyze innovative methods of renewable energy production and prompt investments in new renewable energy projects, all aiming to meet the escalating market demand for certified renewable energy sources.

Additionally, the ESRS’s stringent criteria for attributing renewable energy consumption are set to incentivize organizations to procure energy exclusively from verified renewable sources. This push is expected to accelerate the adoption of renewable power purchase agreements (PPAs) and similar contractual arrangements centered on sourcing energy solely from certified renewable sources. By propelling this shift towards renewable energy consumption and energizing the GoO market, the ESRS not only champions sustainable practices but also fuels the growth and advancement of the renewable energy sector, aligning with and propelling the EU’s ambitious climate objectives.

ESRS implementation and potential challenges ahead

Implementation of ESRS brings forth the challenge of an increased administrative burden and the complex nature of sustainability reporting, potentially burdening businesses financially. The question of who bears these costs becomes paramount, urging industry stakeholders to deliberate on equitable distribution. Technological innovations to streamline reporting will be key in alleviating this challenge. Finding a balance between accountability and practicality while managing complexities remains a collective endeavor crucial for effectively navigating the terrain of ESRS implementation.

Companies navigating the European Sustainability Reporting Standards (ESRS) face critical directives in disclosing their renewable energy composition and Scope 2 greenhouse gas emissions related to acquired renewable electricity. The emergence of green tariffs within the EU necessitates stringent validation using Guarantees of Origin (GoOs) to authenticate renewable energy sources. To reinforce renewable energy credibility, Power Purchase Agreements (PPAs) should encompass bundled GoOs, affirming the origin of sourced energy. However, choosing PPAs might result in untradeable GoOs, potentially leaving prices unaffected. Despite this, companies leveraging GoOs in procurement endeavors will likely contribute to increased demand, aligning with annual disclosure mandates entrenched within sustainability reports.

Anticipated developments in renewable energy markets

The anticipated surge in demand for documented renewables is bound to revolutionize how companies approach their energy sources. As these reporting standards come into play, there’s a crucial shift—firms failing to substantiate their clean energy consumption using Guarantees of Origin (GoOs) might face elevated capital costs. Furthermore, the rise in demand is poised to spur an increase in supply – ultimately yielding long-term benefits for consumers. The uptick in demand doesn’t automatically translate to a robust return on investment for originators or suppliers. Staying abreast of ongoing updates and changes in the landscape becomes paramount. Being informed isn’t just a choice; it’s a strategic necessity in navigating the evolving market dynamics and ensuring sustainable practices while navigating the intricacies of the changing energy market.

Driving sustainability forward with ESRS

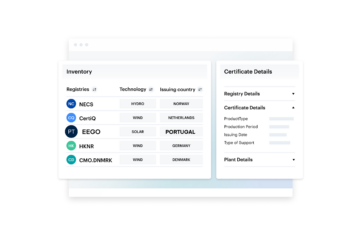

The implementation of the European Sustainability Reporting Standards (ESRS) within the Corporate Sustainability Reporting Directive (CSRD) signifies a monumental leap toward stringent reporting practices across various sectors. ESRS’s focus on market-based energy consumption reporting and comprehensive disclosures echoes a transformative commitment to transparency and accountability across environmental, governance, and social spheres within European corporations. Its impact extends far beyond compliance, standing as a pivotal tool in aligning sustainability reporting with financial evaluations, and guiding informed investment choices. As ESRS shapes the renewable energy sector, sparking heightened demand for certified renewables and intensifying the significance of Guarantees of Origin (GoOs), complexities emerge. In navigating this evolving landscape, CerQlar emerges as an essential tool, offering a cutting-edge platform designed to streamline the management of GoOs and aid companies in meeting their sustainability and compliance objectives efficiently.