Understanding the GO Market: Seminar Highlights and Insights

On September 27, CerQlar joined forces with Montel to host an enlightening in-person seminar in the city of Vienna, where the intricacies of the Guarantees of Origin (GoO) market took center stage. The event brought together a distinguished panel of industry luminaries, including Laura Malinen, Market Manager at Montel Marketplace, and CerQlar’s own experts: Konstantinos Sklavenitis, Manuela Rodriguez, and Martin Andersson.

Here are some of the key takeaways from their informative presentations:

Understanding Guarantees of Origin

The seminar unfolded with Laura Malinen’s comprehensive introduction to Guarantees of Origin (GoOs), dispelling common misconceptions. She underscored the vital role of GoOs in validating the origin of green electricity, highlighting their unique life cycles. Laura clarified that contrary to popular belief, there isn’t a singular ‘European Guarantee of Origin’.

Instead, these certificates are issued by national bodies, maintaining consistent data content across EU nations. AIB membership mandates specific data fields in each GoO, and these certificates are based on actual meter readings, ensuring accuracy.

Laura shed light on AIB’s crucial role in calculating the European residual mix, a key factor in determining each country’s end mix. Post-issuance, GoOs can be transferred, traded, or canceling- which is where the complexity begins.

Addressing post-trade operations

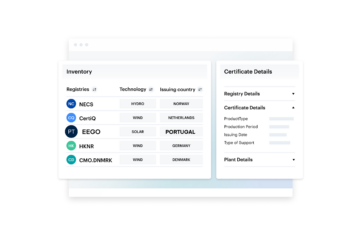

Next, Martin Andersson, Head of Product Management at CerQlar, delved into the realm of post-trade management operations. He elucidated that these operations encompass activities occurring between trade confirmation and settlement, ensuring mutual satisfaction. However, existing challenges arise from reliance on non-integrated systems like Excel, Macros, various registry platforms, in-house systems, and ETRM systems. Ad hoc procedures can lead to operational risk, potentially resulting in inefficiencies or substantial trading losses. Martin provided poignant examples, including discrepancies in trade records, slow position calculations, expiring certificates, and irreversible cancellations, underscoring the imperative of effective post-trade management.

Preparing for GoO market growth

As projections hint at an upsurge to 8 billion GoOs by 2030, preparations for substantial market growth become imperative. Martin explains that the existing 900 million GoOs already strain market participants, signifying the need for enhanced processing and handling methods. Failure to implement solutions may lead to increased handling costs and lapses in meeting obligations.

Risks in post-trade management of GoOs

The presentation highlighted how risks in GoO portfolio management emanate from various sources – encompassing inadequacies in processes, deficiencies in systems, external events, and regulatory changes. Examples include issues with contracts, missed trade details, and disruptions due to events or regulatory shifts. Vigilance and effective mitigation strategies are crucial. To effectively mitigate risks in GoO portfolio management, several key measures should be implemented. These include clear segregation of duties, employment of a robust system designed for GoO portfolio management, safeguarding against external events at a contractual level, and readiness for future regulatory requirements.

Improving your risk management

During a dedicated session, CerQlar’s Account Executive, Konstantinos Sklavenitis, delved into the multifaceted risks that permeate the Guarantees of Origin market. These encompass conflicts, the unpredictable rollercoaster of electricity prices, ambitious yet challenging environmental pledges, along with sentiments on their performance. Additionally, new legislation, financial stress on utilities, consumer payment issues, and the entry of fresh industry players all contribute to the dynamic landscape. In recent years, the market has witnessed a substantial surge in volume, resulting in considerably higher GoO prices.

This growth surge, attributed to geopolitical shifts and a more resolute commitment to emissions reduction targets, saw prices spike by a staggering tenfold at its peak. This intensified scrutiny on GoO portfolio management, highlighting the pivotal role of effectively managing risk in this evolving landscape. Konstantinos further elaborated on CerQlar’s mission to establish a pioneering technology standard, one that empowers Energy Attribute Certificate (EAC) markets to adeptly meet the escalating demands of an ever-more intricate customer base.

The regulatory framework

Manuela Rodriguez, Legal Counsel at CerQlar, underscored the importance of anticipating future regulatory changes. She provided an insightful overview of the evolving regulatory framework and explained the concept of ‘full disclosure’. This approach aims for transparency and informed choices based on environmental impact, achieved through GoOs and supplier information.

The ‘Understanding the GO Market’ seminar provided invaluable insights into the GoO market, post-trade operations, risk management, and regulatory considerations. Attendees gained a profound understanding of the complexities and strategies crucial for success in this evolving landscape. For a detailed recap and comprehensive insights from the seminar, delve deeper into our ebook.

Download your copy here to unpack the intricate world of Guarantees of Origin (GoO) trading.