Optimize Your Energy Certificate Management with CerQlar Position View

In the rapidly expanding Energy Attribute Certificate (EAC) market, staying ahead requires access to advanced tools that empower informed decisions.

Position View is a robust tool that provides an integrated view of trades and inventories, empowering market participants to manage their portfolio positions effectively.

Through this powerful tool, effective management of portfolio positions becomes more than a possibility – it becomes a strategic advantage.

Navigating complex certificate trades with Position View

Position View serves as a comprehensive hub for both trade and inventory management, an absolute necessity for energy producers, utilities, and trading entities.

Some of its key capabilities include:

- Forward Trade Book and Inventory Integration

CerQlar’s Position View feature allows users to consolidate their forward trades and inventories across registries into a single, convenient platform. This streamlines the management process and saves valuable time and effort. Furthermore, the platform normalizes the data, enabling users to compare, filter, and aggregate information from various sources. With this consolidated view, users can easily identify certificates engaged in trade and those available for future trading, facilitating strategic trade planning.

- Masterful Data Management

Position View excels at aggregating and filtering data based on various parameters such as issuing country, production date, and certificates involved in active trades. This simplifies the trade process by providing clear visibility into certificates nearing expiration that require immediate action, whether it’s trading or cancellation. Users can easily select certificates for specific trades, enhancing efficiency and decision-making.

- Advanced Customization

Position View stands out with its unparalleled flexibility in aggregating and manipulating data, giving users full control over their views and insights. The platform allows easy customization and changes in viewpoints, empowering users to optimize risk management strategies based on their unique needs The aggregations in Position View can also be customized according to parameters such as expiration date, country of origin, technology, and more. This empowers users to tailor their portfolio view to focus on the certificates that are most relevant to their current needs or specific trade requirements. Customizable aggregations provide a granular understanding of the portfolio and enhance decision-making capabilities.

- Holistic Portfolio Insights

Position View provides users with a comprehensive view of their portfolio by displaying short and long positions. This holistic perspective allows users to understand the state of each certificate and assess their long, short, and net position per aggregation. With this information at hand, users can plan for future market shifts and identify potential trade opportunities.

Discover how Portfolio Managers can gain more control over a dynamic market. Download our FREE guide today.

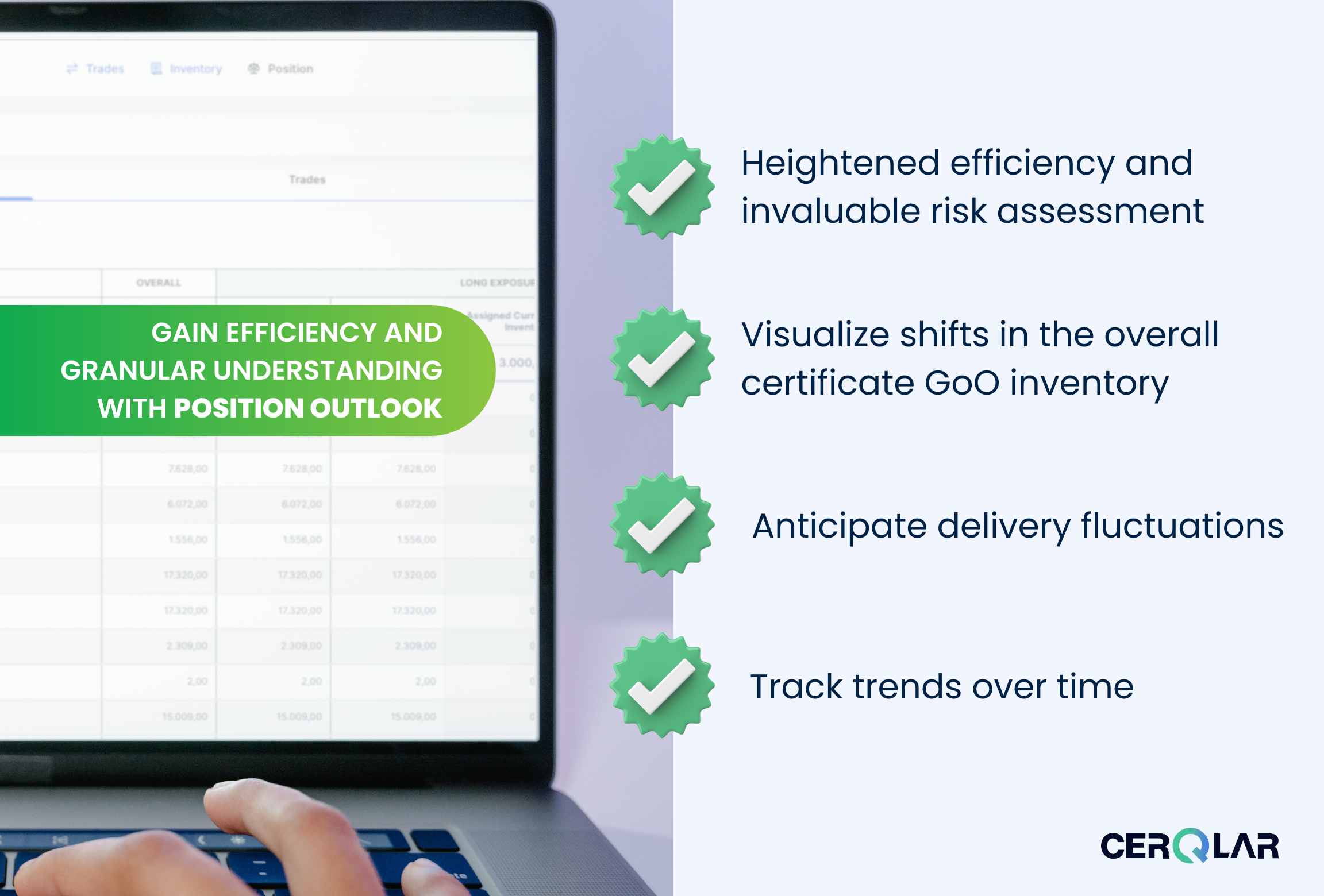

Position outlook: Gaining efficiency and granular understanding

A standout among features, the Position Outlook offers heightened efficiency and invaluable risk assessment. Visualize shifts in the overall certificate GO inventory, anticipate delivery fluctuations, and track trends over time.

Some of the key components of position outlook include:

- Net Certificates Trend Line

The Net Certificates trend line showcases the total certificate count within the portfolio, highlighting fluctuations over time due to incoming and outgoing deliveries. By following this trend line, users gain insights into certificate flow, enabling them to make well-informed decisions aligned with their evolving portfolio dynamics.

- Delivery Bars

Delivery bars represent the volume of certificates to be added or subtracted from the position over time. These bars reflect the aggregate volume scheduled for each calendar month and provide insights into anticipated changes in the portfolio. By understanding the future impact of deliveries, users can proactively adjust their trading strategies to optimize their position.

- Time Aggregation

Position outlook permits users to explore the portfolio’s status across diverse timeframes—Month, Quarter, or Yearly. This feature empowers users to analyze their position from different temporal perspectives, revealing seasonal patterns and long-term trends that might otherwise remain hidden.

- Enhanced Navigation

Enjoy superior navigation with the position outlook. Hover over the graph for instant access to pop-up insights, detailing inbound, outbound, net impact, and overall aggregate certificates for specific time intervals. Additionally, a scroll bar facilitates seamless exploration of broader delivery ranges, allowing users to tailor the graph’s timeframe to their requirements.

Moving forward with Position View

Position View emerges as an indispensable powerhouse, enabling market participants to not only optimize profits but also wield data-driven prowess over their energy certificate portfolios. With an extensive range of capabilities, including robust data aggregation, precision filtering, concise short and long position representation, and the illuminating position outlook feature, Position View empowers users to maintain a leading edge in the field, all while adeptly managing their portfolios.

By leveraging Position View, market participants can effortlessly handle high volumes of GOs and make the most out of their EAC inventory. The tool’s user-friendly interface and advanced functionalities facilitate seamless trading activities and equip users with the necessary insights to capitalize on market growth.