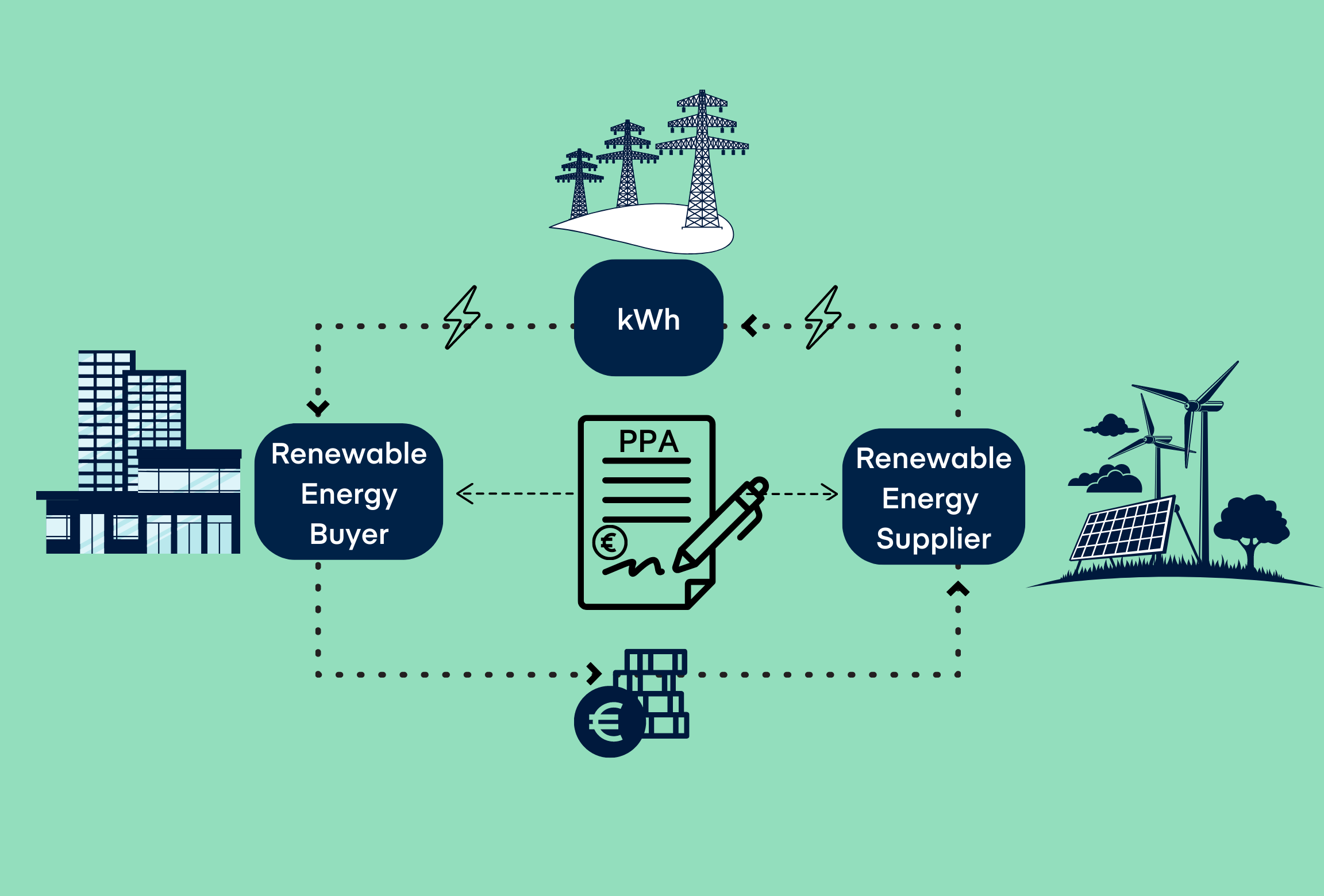

Power Purchase Agreements (PPAs): Driving renewable energy transition and price determination

As the push for renewable energy adoption intensifies in Europe, Power Purchase Agreements (PPAs) have emerged as a vital tool in promoting and accelerating the growth of renewable energy projects. PPAs have gained significant importance in promoting and accelerating the growth of renewable energy projects, aligning with the goals of the recently proposed European Commission’s Energy Market Design proposal. In this blog post, we will explore the importance of PPAs, delve into the intricacies of pricing settlement, and discuss the potential impact of policy changes on renewable energy adoption.

Decoding PPA pricing: How renewable energy prices are settled

PPAs serve as contractual arrangements between participants in the renewable energy industry and play a critical role in facilitating the transition to cleaner energy sources. They offer a range of benefits, including:

- Stable supply and competitive rates:

Long-term PPAs provide market participants with a reliable and uninterrupted supply of renewable energy at cost-competitive rates, ensuring stability in energy procurement and reducing exposure to price fluctuations.

- Market visibility and investment opportunities:

PPAs increase market visibility for renewable energy projects, attracting investments from potential stakeholders. This visibility enhances project viability, accelerates expansion, and contributes to the growth of the renewable energy sector.

- Innovation and clean energy adoption:

The increased demand for renewable energy driven by PPAs stimulates innovation within the sector. This innovation leads to advancements in technology, efficiency, and scalability of clean energy sources, facilitating the transition to a greener and more sustainable energy landscape.

- Support for sustainability goals:

PPAs align with sustainability goals by enabling market participants to reduce their carbon footprint. By procuring renewable energy through long-term agreements, businesses and organizations actively contribute to the global transition to a low-carbon economy and support the development of a sustainable energy system.

These agreements generally involve three key stakeholders:

- Developers responsible for constructing and operating renewable projects

- Consumers committing to purchasing the generated energy

- Utilities serving as intermediaries for transmission and distribution.

Different types of PPAs

PPAs come in various forms, including physical, virtual, and sleeved.

Physical PPAs involve the direct purchase of electricity generated by a specific renewable energy project, providing consumers with a stable and long-term supply of clean energy.

Virtual PPAs, on the other hand, allow consumers to procure renewable energy certificates that represent the environmental attributes of the electricity generated by a renewable project, providing them with the environmental benefits without physically receiving the electricity.

Sleeved PPAs combine elements of physical and virtual PPAs, enabling consumers to access renewable energy from a specific project while leveraging the financial and risk management advantages of virtual transactions.

Each type offers unique benefits and flexibility to stakeholders involved in the renewable energy value chain.

PPA pricing: Understanding the dynamics and the impact of policy changes in the European market

The pricing mechanisms in PPAs play a significant role in determining the economic viability of renewable energy projects and providing investors with confidence in the industry.

Let’s dive into some of the key aspects of pricing settlement:

Defining the pricing methods of PPAs

PPAs employ different pricing approaches such as fixed-price, indexed, hybrid, and more. Fixed-price PPAs establish a consistent rate for the duration of the agreement, providing certainty for both buyers and sellers.

Indexed PPAs, on the other hand, tie the pricing to market indicators such as wholesale electricity prices.

Hybrid models combine elements of both fixed and indexed pricing, offering a balanced approach.

Factors influencing PPA pricing

Various factors influence PPA pricing, and they can be divided into project-specific and general market considerations. including:

Project-specific considerations:

Technology: The type of renewable energy technology used in the project (such as solar, wind, or biomass) impacts the production costs

Location: The geographic location of the project affects resource availability, transmission costs, and grid integration

Size and duration: The scale and duration of the project play a role in determining the overall costs and financial returns

Market dynamics:

- Supply and demand: The balance between the supply of renewable energy projects and the demand from consumers

- Renewable energy certificate prices: The value of renewable energy certificates, such as Guarantees of Origin (GoOs)

- Regulatory policies: This includes government policies, incentives, and regulations related to renewable energy, carbon emissions, and clean energy targets

Challenges and Considerations in pricing settlement

Achieving fair and sustainable pricing in PPAs can be complex, with challenges for buyers and sellers including:

- Accurate energy production forecasting:

Predicting the exact energy production from renewable sources can be challenging due to the variability of weather conditions and other factors. Buyers and sellers need to assess and forecast energy output accurately to determine fair pricing.

- Fluctuating market prices:

Market prices for renewable energy can be subject to fluctuations, influenced by factors such as supply and demand dynamics, regulatory changes, and economic conditions. Managing these price fluctuations and ensuring long-term stability in pricing are crucial for successful PPAs.

- Policy and regulatory changes:

The renewable energy landscape is often influenced by evolving policies and regulations. Changes in government incentives, subsidies, or renewable energy targets can impact the economics of PPAs and require adaptability to ensure sustainable pricing.

- Balancing risk allocation:

Negotiating risk allocation between buyers and sellers in PPAs is essential to ensure fairness and mutually-beneficial agreements. Both parties need to assess and mitigate risks associated with energy production, market volatility, force major events, and contractual obligations.

- Financing and creditworthiness:

Securing financing for renewable energy projects and assessing the creditworthiness of both buyers and sellers are critical factors in pricing settlement. Lenders and investors evaluate the financial stability and credibility of the involved parties, which can impact the pricing terms.

Accelerating the growth of renewable energy

Despite the challenges of implementing PPAs, the benefits outweigh the costs, and with the introduction of new European initiatives like the Energy Market Design proposal, PPAs have become a vital component that promotes and accelerates the adoption of renewable energy projects. By understanding the significance of PPAs, exploring pricing settlement dynamics, and keeping a pulse on policy changes, market players can navigate the renewable energy landscape with confidence. Together, we can shape a future powered by renewable energy, fostering environmental stewardship and sustainable growth.

As the renewable energy industry grows and new innovations continue to enter the market, it is essential to ensure that you’re prepared for every development.

CerQlar helps you keep track of your renewable energy inventory, allowing you to anticipate market trends, and take advantage of sudden market shifts. Our team is closely monitoring market shifts and diligently working on developing new features to provide you with even more tools to manage your renewable energy inventory and navigate shifting market trends.

With PPAs currently on our roadmap, keep an eye out for new features coming soon.